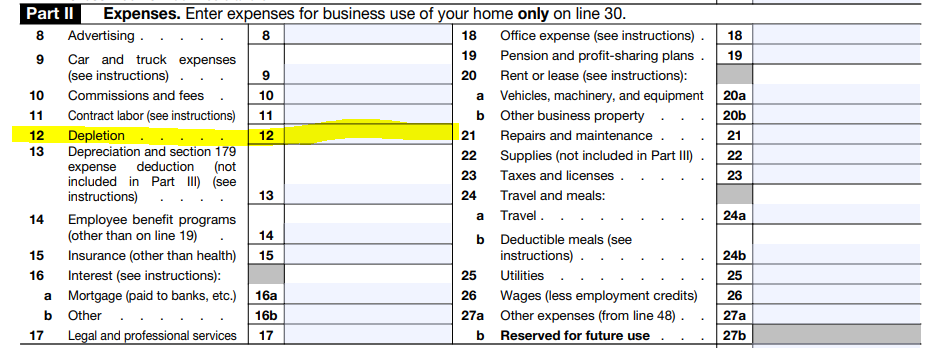

Depletion expenses on line 12 of Schedule C refer to the deduction you can take for the depletion of natural resources used in your business, such as oil, gas, coal, timber, minerals, and other natural resources.

Depletion is a tax concept that recognizes the reduction in the value of natural resources as they are extracted and used in your business operations. As a business owner who uses natural resources, you can claim a deduction for the cost of depletion as an ordinary and necessary business expense.

There are two methods for calculating depletion expenses, which are:

- Cost depletion: This method calculates depletion based on the cost of the natural resource, as well as the amount of the resource extracted and used in your business operations. The cost basis for depletion includes the cost of acquiring the resource, such as the purchase price, exploration costs, and other related expenses.

- Percentage depletion: This method calculates depletion based on a percentage of the gross income from the natural resource. The percentage depletion rate varies depending on the type of natural resource being extracted and used in your business.

You can choose which method to use for each natural resource, but you cannot use both methods for the same resource in the same tax year.

When reporting depletion expenses on Line 12 of Schedule C, you should include the total amount of depletion expenses for all natural resources used in your business during the tax year. It’s important to keep accurate records and documentation of your depletion expenses, including receipts, invoices, and other documentation, in case you are audited by the IRS.