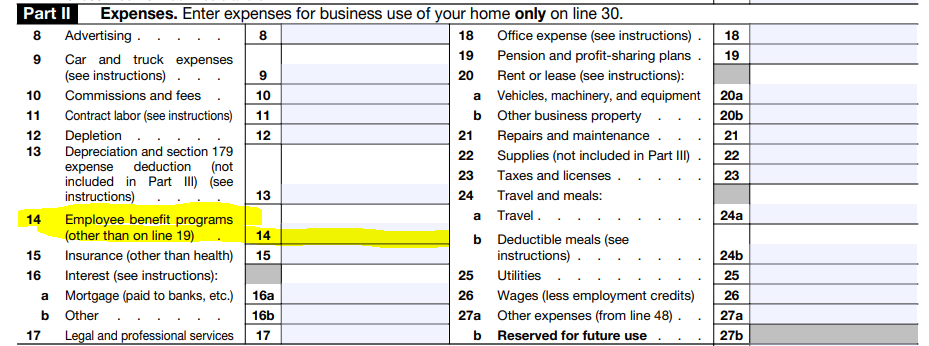

Line 14 on Schedule C of the tax form relates to “Employee Benefit Programs,” which refers to the costs associated with providing employee benefits such as health insurance, retirement plans, and other benefits to your employees.

If you are self-employed and have no employees, you should not report any amounts on Line 14. However, if you do have employees, you may be eligible to deduct the cost of providing employee benefits on Line 14.

Employee benefits that may be deductible on Line 14 include:

- Health insurance premiums: You can deduct the cost of providing health insurance to your employees, including the portion of the premiums you pay on their behalf.

- Retirement plans: You can deduct the cost of providing retirement benefits to your employees, including contributions you make to their retirement plans.

- Life insurance premiums: You can deduct the cost of providing life insurance benefits to your employees, including the portion of the premiums you pay on their behalf.

- Other benefits: You may be able to deduct the cost of providing other benefits to your employees, such as disability insurance, dental and vision coverage, and other fringe benefits.

It’s important to note that there are certain requirements and limitations associated with deducting employee benefit expenses. For example, if you provide health insurance to your employees, you must meet certain criteria in order to qualify for the deduction.

You should keep accurate records of your employee benefit expenses, including receipts, invoices, and other documentation, in case you are audited by the IRS. If you have any questions about how to report employee benefit expenses on your tax return, it’s a good idea to consult with a tax professional or accountant.